Financial & Business Association

of Euro-Asian Cooperation

The V joint forum of the Association of Banks of Russia and the US-Russian Business Council "Fintech and the New Digital Infrastructure," held online on February 4, 2021, attracted increased interest not only in the financial and banking communities of the two countries. Among the two hundred participants of the Forum were Heads of the largest banks in Russia and in the world, Representatives of leading Audit Firms and Consulting Companies, International payment systems and Financial and Technological Companies, Business Associations, Ministries and Departments, Research Institutes and Universities.

The V joint forum of the Association of Banks of Russia and the US-Russian Business Council "Fintech and the New Digital Infrastructure," held online on February 4, 2021, attracted increased interest not only in the financial and banking communities of the two countries. Among the two hundred participants of the Forum were Heads of the largest banks in Russia and in the world, Representatives of leading Audit Firms and Consulting Companies, International payment systems and Financial and Technological Companies, Business Associations, Ministries and Departments, Research Institutes and Universities.

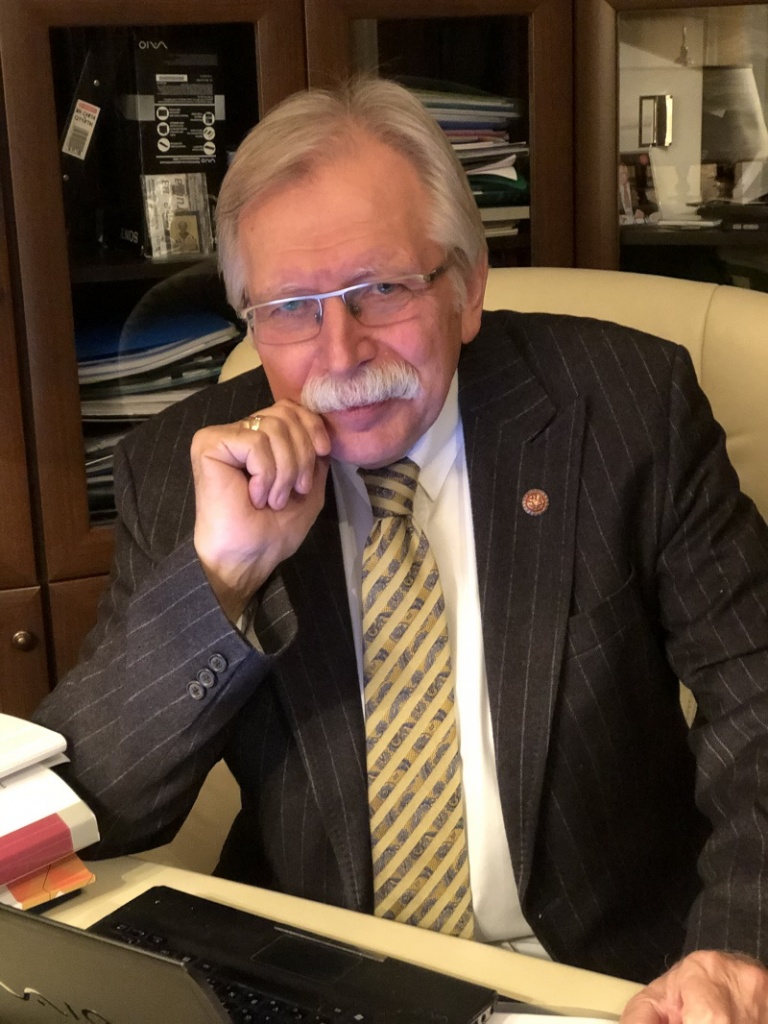

Financial and Business Association of Euro-Asian Cooperation was represented by member of the Executive Board of FBA ЕАС Oleg Preksin.

Financial and Business Association of Euro-Asian Cooperation was represented by member of the Executive Board of FBA ЕАС Oleg Preksin.

From the Russian side the main report was made by Ivan Zimin, Director of the Financial Technology Department of the Bank of Russia, whose report "Financial Regulation and New Digital Infrastructure" was devoted to the policy of the Central Bank on issues related to digital innovation. The key speaker from the American side was the Senior Director, Head of digital and crypto products of the Visa group (San Francisco) - Kai Sheffield. His presentation - "The Rise of the Crypto Currency: From Stable coins to Digital Currencies of Central Banks," gave an overall picture of the digitalization development in the monetary and financial sphere.

Representatives of Mastercard, Microsoft, Cisco and the City group dedicated their speeches to the new developments in the fintech industry in Russia and in the world, while questions from the Russian side (Sovcombank, Bank Uralsib, SKB Bank, Diasoft and NSPK) were raised about the adaptation of commercial banks to the new digital infrastructure.

Speakers were unanimous, noting the usefulness of the dialogue and its feasibility to continuation in online and offline formats.